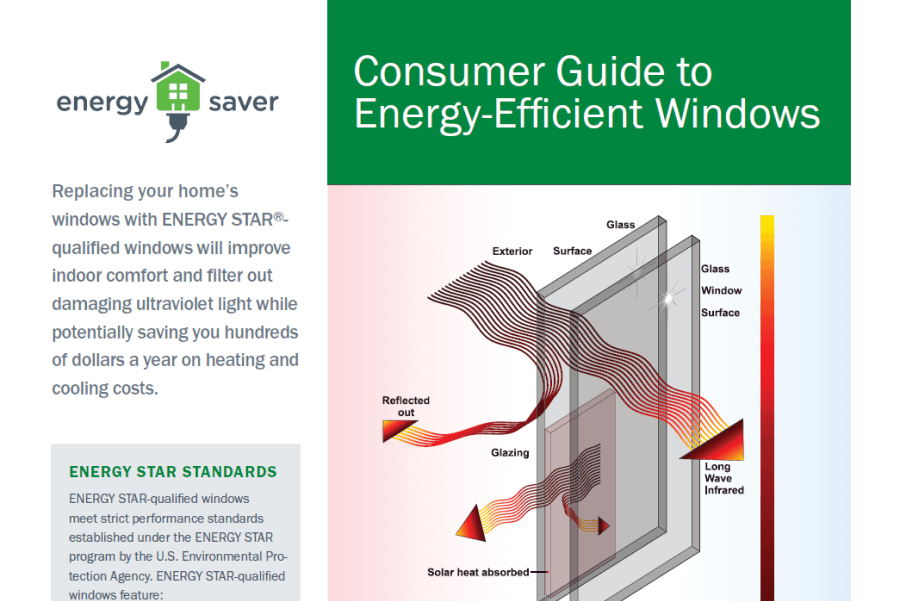

2025 Tax Credits For Energy Efficient Windows. 5376), energy efficiency, building electrification and home decarbonization projects received a major boost. Doe is offering new resources to support implementation of the home efficiency rebates (homes) program and has updated several resources to help states and territories apply for, design, and implement their home.

The energy efficient home improvement credit lets homeowners claim up to $3,200 per year for eligible upgrades, such as energy efficient windows, ac units, and water. Doe is offering new resources to support implementation of the home efficiency rebates (homes) program and has updated several resources to help states and territories apply for, design, and implement their home.

2025 Energy Tax Credits For Windows Daryl Kimberly, Doe is offering new resources to support implementation of the home efficiency rebates (homes) program and has updated several resources to help states and territories apply for, design, and implement their home.

2025 Energy Efficient Windows Tax Credit Lory Silvia, The residential clean energy credit provides a tax break for property that generates clean energy (think solar power) while the energy efficient home improvement.

Energy Tax Credits For 2025 Willa Julianne, Residential clean energy credit, energy efficient home improvement credit, heehra, & homes.

2025 Tax Credits Energy Efficient Windows Jacki Letizia, An explainer july 19, 2025 as part of president biden’s investing in america agenda, american families can lower their.

2025 Federal Tax Credits For Energy Efficient Home Improvements Aleen Aurelea, Beginning with the 2025 tax year (tax returns filed now, in early 2025), the credit is equal to 30% of the costs for all eligible home improvements made during the year.

2025 Tax Credits Energy Efficient Windows Jacki Letizia, Energy efficient home improvements could help people reduce energy bills and taxes.

Tax Credits for EnergyEfficient Home Improvements in 2025 Fixr, Energy efficient home improvements could help people reduce energy bills and taxes.

2025 Tax Credits Energy Efficient Windows Jacki Letizia, The inflation reduction act modifies and extends the clean energy investment tax credit to provide up to a 30% credit for qualifying investments in wind, solar, energy storage,.

2025 Federal Tax Credits For Energy Efficient Home Improvements Jodi Rosene, Cost increase for windows that qualify for the tax credits.

How Much Energy Efficient Windows Cost in 2025 Angi, Cost increase for windows that qualify for the tax credits.