California Exit Tax 2025. The governor proposes to close the budget. Starting in 2025, the proposed tax rate would be 1.5% for net worths exceeding $1 billion.

After the pilot ends in early 2025, the department will create and publish a report on its findings, prehoda said. This exit tax would be on both recognized income and unrealized appreciation in asset values over $5 million.

The california exit tax applies to individuals who have been residents of california for at least two of the past five years and who have a net worth of $2 million or.

Video • California Wants to Impose an "Exit Tax", The exit tax would take 1%. At that point, lawmakers would have to pass.

When Are You Exempt from California Exit Tax? Internal Revenue Code, Gavin newsom’s opposition, but ultrawealthy taxpayers should be wary of what it. The 14.4% rate is a combination of the highest marginal tax bracket, mental health tax and now uncapped state disability insurance, which is a payroll tax.

Pimp Master Broda on Twitter "Nerdrotics Did you pay your California, Individuals and businesses seeking to relocate outside the state are now. Calculate your income tax, social security.

What is California’s Exit Tax?, This exit tax would be on both recognized income and unrealized appreciation in asset values over $5 million. Tax calculator is for 2025 tax year only.

OpEd California wealth and exit tax would be an unconstitutional, The legislature is again proposing a tax on “extreme wealth” in california, a move lawmakers say could bring in billions in state revenue by raising taxes on. Capital gains tax on property sales.

Fastest 2025 California Tax Calculator With Tax Rates Internal, The california exit tax applies to individuals who have been residents of california for at least two of the past five years and who have a net worth of $2 million or. The legislature is again proposing a tax on “extreme wealth” in california, a move lawmakers say could bring in billions in state revenue by raising taxes on.

California Exit Tax Latest Updates for 2025, Tax calculator is for 2025 tax year only. California’s wealth tax proposal is unlikely to pass, thanks in part to gov.

It's Time To Go Over Half Of All California Voters "Have Considered, Quickly figure your 2025 tax by entering your filing status and income. The governor proposes to close the budget.

2025 Tax Brackets California Penni BarbaraAnne, It pays to know what. Calculate your annual salary after tax using the online california tax calculator, updated with the 2025 income tax rates in california.

Understanding the California Exit Tax Ridgecrestpact, Quickly figure your 2025 tax by entering your filing status and income. It pays to know what.

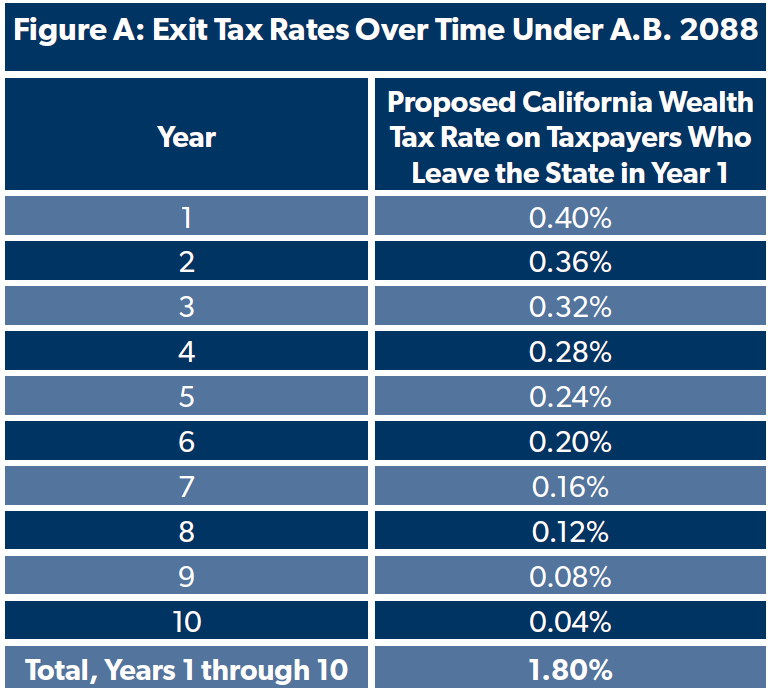

The exit tax is designed as a 0.4% tax on incomes, business revenues, or investment gains for those who meet certain wealth thresholds upon leaving california.